SHERIDAN, WYOMING – October 22, 2025 – After two years of stagnation, Germany’s online retail sector is back on a growth path. The EHI and ECDB E-Commerce Market Germany 2025 study reports that the 1,000 largest B2C online shops increased their combined net e-commerce revenues from €77.5 billion in 2023 to €80.4 billion in 2024 — a 3.8% nominal rise (3.0% in real terms). Analysts now forecast a further 5.3% gain for 2025, signaling renewed momentum across Europe’s largest digital retail market.

Market Concentration: Growth Driven by the Biggest Players

The latest EHI/ECDB data confirm a familiar pattern — the strongest growth is concentrated among the top-tier players. The ten largest online retailers expanded sales by 8%, compared to just 1.3% for the remaining 990. “The market remains highly concentrated. Major providers are growing faster and securing an ever-larger share of total sales,” said Dr. Friedrich Schwandt, CEO of ECDB.

- Top 10 retailers now account for 38.8% of total revenue.

- Top 100 shops generate 70.7% of the total market volume.

Amazon.de leads the field with €15.0 billion in sales, followed by Otto.de (€4.4 billion) and Zalando.de (€2.6 billion). Emerging global platforms such as Shein and Shop Apotheke are also reshaping the competitive landscape.

New Growth Drivers: Grocery and Health Retailers Rise

EHI’s experts highlight a key shift in consumer behavior — the surge of everyday categories in online sales. Platforms like Rewe.de, which entered the Top 10 with a 33.5% increase to €920 million, are benefiting from changing purchasing patterns. “In addition to established players, providers of everyday goods are becoming increasingly important,” explained Lars Hofacker, E-Commerce Research Director at EHI. “This is mainly due to evolving shopping habits: groceries are more frequently ordered online — for delivery or pickup — and e-prescriptions are boosting digital pharmacy sales.”

Other fast risers include Shop-Apotheke.com (+29.1%) and Shein.com, which made its Top 10 debut with €1.1 billion in sales.

Temu’s Rapid Ascent Highlights Market Volatility

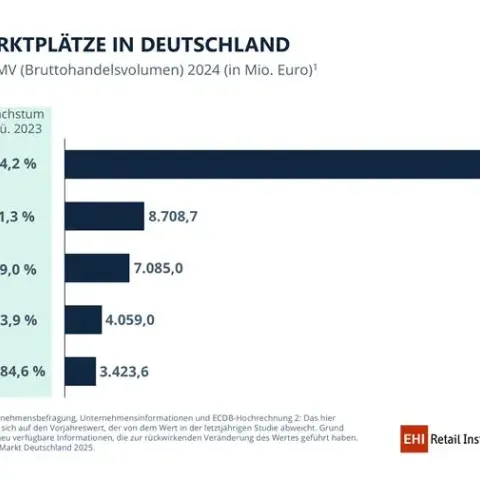

While Amazon, eBay, and Otto continue to dominate the B2C marketplace segment, new entrants are shaking things up. Chinese platform Temu.com posted a staggering 285% growth, reaching €3.4 billion in gross merchandise volume (GMV) and entering the Top 5 for the first time.

“This shows how quickly international newcomers can alter market structures and challenge established platforms,” said Hofacker. “Temu’s rise underlines how intense competition in e-commerce has become — and how rapidly market dynamics can shift.”

Payments Landscape: Wallets Take the Lead

The study also reveals major changes in online payment behavior. Digital wallets are gaining ground at a remarkable pace:

- Apple Pay is now accepted by over one-third of top shops — up 43% year-over-year.

- Google Pay grew 63%, becoming the third most common wallet.

- PayPal remains dominant, offered by 95% of the top 1,000.

Analysts are also watching emerging players like Wero, which could further disrupt the market once integrated into major retail platforms.

Strategic Takeaway: Consolidation Meets Innovation

The E-Commerce Market Germany 2025 study paints a dual picture: increasing concentration among large, established players, but also rapid innovation and category diversification. For retailers, this means two imperatives — scale and specialization. Grocery and health-focused platforms demonstrate how niche categories can thrive when aligned with convenience trends and digital service integration.

The full EHI/ECDB study, including detailed datasets on the Top 1,000 B2C online shops and Top 10 B2C marketplaces, was presented at the EHI Connect Conference on September 30 in Düsseldorf. It is now available for download via the EHI website.